No cometas el error de pensar que tu tarjeta de crédito es una extensión del dinero que ganas

Es muy probable que uno de tus primeros contactos reales con el mundo financiero, haya sido cuanto obtuviste tu primera tarjeta de crédito. Seguramente, en ese momento percibiste una inmensa sensación de libertad, poder económico y margen de maniobra. Pues bien, vas por el buen camino, porque las tarjetas de crédito no solamente son útiles para atender imprevistos o adquirir lo verdaderamente necesario cuando el flujo de efectivo no está a nuestro favor, sino que además, sin las tarjetas de crédito no podrás rentar un vehículo, reservar alojamiento en un hotel, o adquirir un billete aéreo por Internet. Sin ellas, tampoco te beneficiarías de algunos servicios interesantes, como el financiamiento sin intereses (gratuito) cuando cada mes pagas completamente el saldo deudor, o los seguros de accidentes en viajes, la compra protegida o la extensión de garantía en algunos productos.

Entonces, bienvenidas las tarjetas de crédito, pero para que sean tus aliadas debes aprender a utilizarlas correctamente. Ten siempre en cuenta que el hecho de tener una tarjeta de crédito puede crear un espejismo sobre el poder real de gasto que tengas, y ese espejismo te llevará a un patrón de consumo en el que de manera recurrente gastarás más dinero del que ganas; a veces con terribles consecuencias para tu economía personal o familiar.

Una de las deudas más costosas que se adquieren es la que proviene del uso de la Tarjeta de Crédito; por lo general, las tasas de interés que cobran son bastante altas y eso perjudica tu flujo de efectivo y tu capacidad de maniobra.Para evitar situaciones embarazosas que incluso pueden llegar a arruinarte, aquí te indicamos dos consejos básicos:

- Evita el impulso de recurrir a las Tarjetas de Crédito para realizar compras básicas o cotidianas, o de adquirir artículos que realmente no necesitas pero que te atraen por su bajo precio o porque están en promoción.

- Trata siempre de hacer el pago completo mensual del saldo deudor (sin intereses). En caso de que no puedas pagarlas completamente, paga por lo menos el doble de lo que te indican como pago mínimo de ese mes. De esa manera evitarás pagar un importe significativo por concepto de intereses, y te librarás de una larga y pesada carga financiera que te impedirá alcanzar tus metas.

En conclusión, recuerda que la tarjeta de crédito no es una extensión de tus ingresos, y cada vez que las utilices estarás adquiriendo una deuda que por lo general deberás pagar con altas tasas de interés. Aprende a aprovechar sus beneficios, sin caer en la tentación de gastar más de lo que ganas.

Un perfil de inversión no es mejor o peor que otro; a la final todo depende del nivel de riesgo que estés dispuesto a tolerar.

No todas las personas tienen la misma propensión para asumir riesgos. Algunas son demasiado arriesgadas, mientras que otras son muy temerosas. Como la incertidumbre no se tolera de igual manera, la decisión de elegir entre una u otra alternativa de inversión, dependerá (y mucho) de tu perfil de inversor. Estas y otras razones, como tu situación personal o la cultura financiera que poseas, determinarán tu perfil de inversor.

Básicamente, existen cuatro tipos de inversores con los que se asocian distintos productos o activos de inversión.

- Conservadores: Aunque perciban interesantes ganancias potenciales, estas personas están muy poco dispuestas a arriesgar su dinero. Anteponen la certeza y la seguridad ante cualquier elección que implique aceptar la incertidumbre. Son propensos a invertir sus ahorros en opciones de renta fija (poco rentables) como las cuentas de ahorro y depósitos a plazo

- Moderados: Al igual que los conservadores, a estas personas no les gusta arriesgar el dinero pero les anima la posibilidad de obtener ciertos rendimientos que perciben como potencialmente seguros. Hacen inversiones, siempre y cuando las pérdidas no sean cuantiosas. Sus opciones preferidas de inversión también se concentran en las operaciones de renta fija, como bonos, obligaciones, letras y pagarés.

- Agresivos: Las personas con perfil agresivo son propensas a arriesgar mucho dinero para obtener rendimientos superiores. Saben combinar información e intuición. Por lo general operan en el mercado de renta variable (alto riesgo) con proyección en el corto y mediano plazo, pero mantienen parte de sus activos de inversión en operaciones de renta fija.

- Muy agresivos: Saben tolerar la incertidumbre y aunque reconocen que el riesgo es muy alto, no temen hacer este tipo de inversiones porque los beneficios potenciales serán muy significativos si se les compara con las pérdidas que están dispuestas a aceptar. Suelen actuar movidos por la intuición. Se concentran principalmente en el mercado de renta variable con proyección en el corto plazo.

Recuerda que no hay perfil bueno o malo; ninguno es mejor que otro. Tu perfil del inversor está asociado con el nivel de riesgo que puedes tolerar y dependerá principalmente de factores como tu horizonte de inversión, la aversión al riesgo, tu situación financiera personal, la necesidad de liquidez que tengas en un momento dado, y el grado de cultura financiera que hayas obtenido.

Algunas deudas serán necesarias para pagar la educación de tus hijos o para generar nuevos ingresos

Seguramente, desde que eras pequeño has escuchado con insistencia que las deudas no eran buenas para tu salud financiera y que por lo tanto debías evitarlas. En parte tenían razón; no es muy inteligente que vivas eternamente endeudado con la tarjeta de crédito porque la utilizas para pagar tus gastos de consumo. Muchos padres también decían que solamente había que pedir prestado en momentos muy críticos, porque además de la vergüenza que eso causaba, quizás se tuvieran dificultades para honrar el compromiso de devolver el dinero recibido en las condiciones pactadas.

Es cierto que no todo lo que brilla es oro, pero tampoco todo lo que veas de color negro es carbón. Hay casos en que las deudas se adquieren para algo más noble que comprar el teléfono portátil de última generación, o para irnos un mes de vacaciones a una paradisíaca isla caribeña. A veces necesitarás endeudarte para la educación de tus hijos o para generar ingresos, por ejemplo: cuando compras herramientas y equipos que necesitas para hacer tu trabajo, o cuando te inscribes en un seminario de formación; ese tipo de deudas son necesarias y el hecho de que las adquieras demuestra que estás actuando de manera inteligente. También puedes endeudarte para comprar un bien del que sabes que aumentará su valor con el paso del tiempo. En cada uno estos casos, estarás adquiriendo una deuda buena porque gracias a ella, a la larga podrás mejorar tu situación financiera, tu bienestar y tu calidad de vida. Asume que la deuda buena es aquella que adquieres para comprar bienes que aumentan su valor con el paso del tiempo, o las que te permiten obtener beneficios económicos (inmediatos o futuros). Considera también que una deuda es buena cuando adquieres bienes que te permiten reducir los gastos recurrentes. Como verás, no es lo mismo pedir dinero prestado para el consumo inmediato (que no te reportará ningún beneficio económico) que endeudarte para asegurar la educación de tus hijos, o para hacer una inversión a medio o largo plazo.

De manera general, asume que la deuda mala (la que debes evitar) es la que contraes en función de tus hábitos de consumo. Si necesitas pagar el mercado semanal con tarjeta de crédito y te excedes en el plazo de pago sin intereses, estarás adquiriendo una deuda mala porque: 1) estás gastando lo que no tienes; 2) te estás endeudando para poder vivir, y 3) no solamente tendrás que devolver (tarde o temprano) el dinero que pediste prestado, sino que lo tendrás que hacer pagando los intereses (que no son bajos), con lo que tu probabilidad de ahorro será cada vez menor. Igual ocurre con los pagos con tarjeta de crédito en restaurantes (salvo que lo hagas para convencer a tu cliente y firmar un buen contrato), o los préstamos para equipar tu casa, salir de vacaciones, o para adquirir el vehículo, por citar algunos ejemplos.

Uno de los grandes errores que se cometen es caer en la tentación de comenzar a pagar un bien o servicio 3 o 4 meses después de adquirido e incluso luego de haberlo disfrutado. Imagínate que tengas la posibilidad de irte dos semanas de vacaciones a Tahití, sin pagar absolutamente nada hasta dentro de 3 meses. ¿tu que harías si dispusieras del tiempo para ello? ¿Durante cuántos meses o años verías mermada tu capacidad de ahorro por esas dos semanas de vacaciones?

Otro error muy grave es el de recurrir a una agencia de consolidación de deudas, o solicitar préstamos rápidos en efectivo (que los aprueban en cuestión de minutos). Por lo general, los clientes que acuden a estas empresas son personas que atraviesan una mala situación financiera y sienten un alivio momentáneo al contratar con ellas, sin considerar que no solamente se mantienen las razones de sus problemas financieros, sino que agravan la situación, puesto que ahora la deuda es mayor que la que tenían.

Dos recomendaciones finales: la primera, nunca te dejes seducir por el crédito fácil y la segunda, antes de endeudarte, pregúntate si verdaderamente necesitas lo que vas a adquirir, asegúrate de que vale la pena y de que estás en condiciones de pagar las cuotas mensuales y las anualidades (no creas que Dios proveerá); piensa en lo que debes sacrificar con la deuda que estás adquiriendo y en los posibles beneficios que esa decisión te reportará. Toma la decisión de endeudarte si después de responder estas preguntas, estás convencido de que tu mejor opción es el endeudamiento.

It is not necessary to have large fortunes to have the need to develop the family budget. Many families think that this budget is not necessary because they only have a modest source of income and their monthly expenses are typical of any average family, like paying rent, utility bills, some escapades to the movies, school for children, or vehicle expenses. Regardless of the economic slack your family may have, you need to prepare the family budget.

Just as it happens in a company, if you do not adequately handle the household economy, you’ll be committing serious mistakes with dire consequences for your pockets (and your health), and you’ll be repeating again and again the infamous phrase: “I can’t make ends meet“.

To avoid such awkward moments, you must bring order to your domestic economy and the first practical step to achieve this is to develop a simple family budget. The budget will bring the bills on time and help you avoid wasting money, allows monitoring of costs to reduce them, prioritize or delete them as far as possible; In addition, if you meet the budget by knowing the economic situation of your family to date, you will be able to make better forecasts, inviting the savings and to protect yourself against unforeseen events such as illness, damage to housing, vehicle breakdowns, etc.

A basic budget has two columns: the INCOME column and the EXPENSES column. In the income column you’ll write any money entries that sustain your family: wages, overtime, financial aid and generally any other source of income your family has during the month.

In the expenses column, you will record all monthly expenses classifying them into three categories:

- Compulsory expenditure (which you can not stop paying and they are constant); for example, rent or home mortgage, a bank loan that you have requested, quotas for Social Security, or payment of your community.

- Necessary expenses (you can not stop paying them, but you can reduce the amount of what you pay); Typical examples of this category correspond to electricity bills, water, telephone, expenses for food, clothing, transportation, etc. You see, you can not help incurring such expenses, but you can take steps to reduce the amount you pay.

- Occasional expenses that can be totally eliminated if necessary, for example leisure and recreation expenses (food and beverages away from home, horseback weekend), non essential consumer goods, electronic equipment, etc.

Once you have registered with honesty all income and all expenses, summarize both columns and get the difference between the two. If the column total expenditure is greater than total income, then I don’t need to tell you (because you’ll already have noticed) that you are in serious economic problems and should start as soon as possible to eliminate incidental expenses and reduce the amount of necessary expenses (unless you’re able to earn more income). If, however, the income column is greater than expenses, you must interpret this difference as your ability to save; if so, mark the aim of saving at least 10% of your monthly income and commit to it.

Remember that the goal is to make the family budget income to cover your family living costs; so when you establish the budget, involve the family for a global commitment to savings and avoiding wastage. The budget will help you identify and eliminate unnecessary costs, reduce unnecessary expenses and reduce bills for necessary expenses.

To have more slack and for your budget to be your best financial partner, avoid as far as possible the use of credit cards, and beware of getting into long-term debt or high interest rates credits as possible (especially consumer credits or loans) and most importantly, never ever forget the golden rule: do not spend beyond your means.

He who has never been afraid of losing money can cast the first stone?. It’s obvious that nobody likes losing money; we care for it as if it were our most precious asset, but we should understand on how that fear can affect our attitude.

The fear of losing money is inevitable (for both poor and rich folks); It is not a fear of cowards, but a necessary fear. The bottom line is not about fear itself, what’s really interesting is how that fear affects us emotionally; in other words, how we manage our money in spite of that fear. On occasions, people fear so much the possibility of losing money, they won’t take any kind of risks, instead they will play it safe and end up losing.

How to manage the perception of fear, the sensation of lost and the experience of failure?

One of the best tricks to overcome your fear of losing, is redefining the concept of failure. What is the meaning of failure for you? You can see it as a tragedy or as a learning experience; You can understand it as a sign to let your plans succeed, or you can view it as an inspiration to go even beyond your desires. Possibly you see failure as a punishment for your ambition, or perhaps you prefer to understand it as a new opportunity; You can also see it as a defeat, while others see it as a sign to start over but more experienced.

Some people get weakened in face of failure, while others grow stronger. How and why does this happen? Basically, the difference won’t be found on objective matters, such as academic degrees, where they live, their age, or their wealth. The difference between one way of seeing the consequences of failure and the other lays on the attitude, and your attitude depends on what you believe in.

Concretely speaking, the fear of losing money is rooted in the fear of failure, and one of the practical ways recommended to overcome the fear of losing money is to assume that no one will take it out of your hands (unless you let them); money also won’t disappear by itself (unless you throw it out the window and the wind carries it away). In any case, you are the great money manager and you know there is no success without taking risks and learning. The more you acquire skills to manage your money, the less aversion to failure you’ll have, and therefore you’ll have less concerns at the possibility of losing money. Remember that no one has become rich without losing some money.

At this point it is well worth extracting a powerful phrase from the book “Rich Dad Poor Dad” whose author, Robert Kiyosaki, says bluntly that the losers avoid failure, while failure turns losers into winners. So you shouldn’t panic in the face of failure because your natural response to that fear will be to do nothing, and you shouldn’t stop playing in fear of losing. Also don’t get compliant for playing it safe because, even when winning, you would not have learned much. Do not forget that you have the sufficient capacity to win, and if you end up losing money, do not worry because you will always have the tools and skills to find new opportunities to recover and recapitalize.

Our final recommendation: don’t be afraid of losing money and never think in terms of poverty, because that is always followed by a large army of burdens, fears and apprehensions.

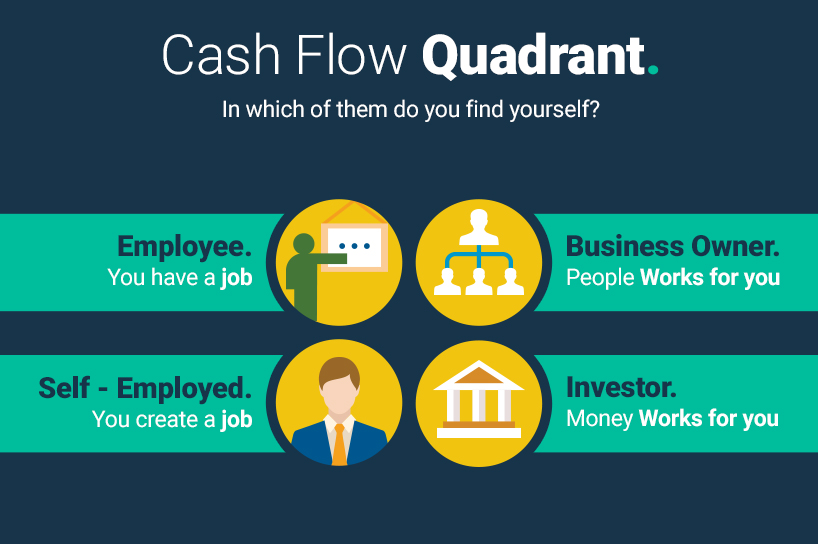

One of the most used diagrams to understand who we are and how we think is the famous money flow quadrant, designed by Robert Kiyosaki to chart the four profiles of people, according to the manner in which they mainly derive their income.

Each quadrant has its own particularities. The way you earn money will depend in which quadrant you are, which –in turn- will depend on the way you think, your interests, your educational background and your skills.

The chart is divided into four quadrants (E-S-B-I)

People located in quadrant [E] (EMPLOYEE) are those who want job security, with a good pay and benefits to offset all the time they devote to meet the financial goals of others. In this quadrant, it doesn’t matter if you’re a delivery guy or an executive officer; In both cases, the money earned is the product of a contractual relationship; That’s what matters. From a financial standpoint, this group of people depends entirely on a salary and other compensations paid by their employers. In short, people on quadrant [E] are employed.

People on quadrant [S] (SELF EMPLOYED) also want security in their financial income, but unlike employees they don’t work for others in a fixed salary, but by maintaining autonomy and control over themselves as well as the work they do and the financial compensation they expect to acquire in terms of knowledge, experience, work hours and the quality of the work they try to do. People in this quadrant focus on the product and have been proven reluctant to delegate. This group is characterized by the abundance of well-trained professionals in specific areas who work on their own (doctors, architects, painters, masons, gardeners, mechanics, dentists, commissioned salespeople, consultants, etc.). In addition to financial appreciating safety, people in this quadrant also value freedom and autonomy. In short, people on quadrant [S] are in control and own their own employment.

The third quadrant [B] (BUSINESS OWNER) corresponds to people whose profiles are opposite to that of employees. They like to delegate and expect others to be the ones who do the work that will benefit them financially. People in this quadrant have the property or have control over the business system; They strive to make the best of the people who surround them and show skills to lead people.

Unlike people from quadrant [S] who focus on the product and whose profit depends on their direct work, people who are in quadrant [B] focus on a comprehensive business system, so they don’t have the need for direct jobs for their income; thus ensuring that money keeps on entering their bank accounts, even when they’re on vacations or physically indisposed to perform some work. In short, people on quadrant [B] have a business system and hire people who will make them earn money thanks to their work.

Finally, the fourth quadrant [I] (INVESTORS) corresponds to those that focus on making money without working, making money work for them. They are people who know and are able to take risks. According to Kiyosaki, in this quadrant is where the money becomes wealth when considering that it is not measured in currency units (or money) but in the number of days that you can live without working directly and maintaining (or even increasing) your welfare and quality of life. In short, people within the quadrant [I] do not need to work directly, or hire people to do the work. Is the money that works for them.

After this quick walk through the money flow quadrant:

- In which of them do you find yourself?

- Have you decided to cross the borders of the quadrant in which you find yourself today?

- In which quadrant you want to be within 3 or 5 years?

- What are the first steps you will take to achieve it?

Finding the answers to these questions will help you make good decisions that will improve your quality of life and bring you closer to achieving your financial goals.

Your Financial Net Worth is one of the indicators that illustrate the ability to achieve financial goals for the short, medium or long term. Basically, it is the result of subtracting your liabilities worth from your assets valuation; that is to say:

Financial Net Worth = Financial Assets – Financial Liabilities

First things first:

To calculate your total Financial Assets, you must know that the most important thing to keep in mind is that your assets correspond to the physical cash you possess to purchase things either now or later. You can also consider as financial assets, those investments that can be converted into fiat money. Consumer goods, such as your clothes, TV, washing machine, furniture and fixtures (unless you’re thinking of selling them) should not be considered as financial assets because they do not contribute to putting money in your pocket.

On the other hand, generally, Financial Liabilities include all debts that you have and any other payment commitment or contractual obligation you have acquired and that involves paying in cash or handing over a financial asset. There are short and long term liabilities, enforceable and unenforceable, contingent liabilities and other, but we’ll leave that for later. For now, the important thing is that you recognize the fundamental differences between assets and financial liabilities.

A simple way to understand the difference between assets and liabilities, is assuming that an asset is anything that puts money in your pocket and a liability is anything that takes it away from you.

Each person, depending on their circumstances, interests and goals, will interpret in one way or another the value obtained by subtracting liabilities from assets; but in any case, a very good recommendation is that you calculate your Financial Net Worth now. Know how much money you have, how much you owe and how much you have left, and then act trying to eliminate the debts of major importance so that once you’ve cleaned up your finances, you begin to build a financial base that allows you to live comfortably (without strain) for at least three months.

Thus, without realizing it, you’ll be starting to get your financial freedom and you may regret not having done so before.

If you do not have credit history, or if you ever have been denied credit, it’s time you start thinking about a secured credit card. As you know, the way you use credit cards widely impacts your financial history; so to make a good start on that history, or to restore a situation of a somewhat weak credit, a good option is to use this type of financial instrument.

In those cards, credit is secured by a deposit made in a saving account specially designed for this purpose. Thus, the credit limit will depend on the amount of that deposit.

Lots of people confuse secured credit cards with prepaid debit cards (or just prepaid cards). These work just as a normal debit card, with the proviso that the available funds have been previously pre-loaded. This category includes discount cards and the ever popular gift card.

With the intention of helping to create responsible spending habits and to contribute with security by taking away the necessity of paying with cash, many parents choose to give prepaid cards to their children; but nevertheless, and contrary to what happens with secured credit cards, the emission of the prepaid card in not informed to the credit agency, and thus the way it’s used won’t have any effect on the construction and consolidation of their personal credit history.

Although in both cases funds are guaranteed, it’s preferable to operate with the secured credit cards, since besides establishing and managing your own credit limit, you’ll be able to build a solid financial history, then within two months, the bank entities could provide the opportunity to apply for a new credit card without the down payment.

When you’re going to invest, the first questions you need to ask yourself is: Is it a worthy investment? Is it advisable to take the risk? One of the most important evaluations to differentiate one investment alternative from another is the combination of risk that you will assume, and the benefits you expect to get (profitability).

Generally, rikier investment should produce higher returns. If it were not so, any investment alternative that report the same potential benefits to another with a lower risk would cease to be attractive.

The risk is linked to the uncertainty of the benefits you actually get by investing. You can earn more than what you expect, less than desired, or you can even lose all the money you invested. There is no way to avoid the risk because profitability will never be assured.

Each alternative for investment is unique because it combines risk with profitability. Since not all alternatives have the same risk or the same return, there are two “laws” that common sense dictates and you should consider when choosing:

- Between two alternatives with EQUAL RISK, you must choose the MOST PROFITABLE ONE.

- Between two alternatives with equal PROFITABILITY, you must choose the one with the LOWEST RISK.

As you can see, you cannot separate the risk that you will assume from the profitability you expect to get, and although an investment with greater risk should produce higher returns, be careful when deciding because there is no guarantee that that will happen. To accept a higher risk does not always lead to greater profitability.

Even though it seems strange, a good salary doesn’t guarantee financial success; also having a low salary does not mean failure. Financial success depends on how you manage your personal finances to improve your quality of life and achieve your goals, regardless of how much money you earn or how big is your spending budget.

Managing your personal finances is a process that begins with knowing your current financial situation; the process continues with the establishment and prioritizing of your goals, so that you can then develop certain strategies that will allow you to get going from your current situation to achieving your goals.

As you see, this is a comprehensive planning process. It is your quality of life that you’ll get to improve and for that you can’t just be focused on a particular interest, neglecting or leaving aside others. Proper personal financial planning will allow you to make smart decisions, including the purchase of your first home, emergency fund management, education for your children, or even how to secure your quality of life after retirement.

It’s not the one who earns the most money that lives better. The one who lives better is the one who is able to get the best possible quality of life, and personal financial planning acts like the map that marks the path to achieve your dreams, realise your ideals and reach your goals. Personal financial planning thus becomes an essential piece of your route; it helps you to achieve your dreams, prioritizes your goals, alerts you about the obstacles which you may find along the way, prevents you from making terrible mistakes, prepares you to face contingencies and unforeseen events and, last but not least, offers first class information so you can make the best decisions.

As you may have noticed, your financial success depends less on your income, but rather on the clarity of your goals and the route you have designed to manage your personal finances.

MONEY RACE STUDIOS 2020 - ALL RIGHTS RESERVED - LEGAL NOTICE - PRIVACY POLICY